Diminishing growth. Inflation. Unpredictable climate patterns. Fraught supply chains… The world is facing a few lean and troublesome years. And grocery retailers are in a tough place. While grocery retail is thought to be less exposed to economic downturns than non-essential retail, and while retailers don’t hold responsibility for inflation-led price hikes, they face the tremendous burden of keeping prices competitively low while optimizing margins and staying afloat.

The food price index has just reached its highest levels this millennium, which means that globally, retailers and suppliers are facing their own cost crisis, as higher direct costs and changing shopper preferences are squeezing margins. While many retailers might report higher sales, volumes will decline, and profits will become harder to generate.

What’s more, financial stress gives rise to challenging phenomena such as shoplifting. Shrink is a growing problem, both by lone and opportunity offenders and organized retail crime, which contributes to $100 billion in shrink that retailers in the U.S. now experience annually, according to the National Retail Federation (NRF).

No time like the present

A stringent economic period may intuitively feel like a bad time to invest in new technology. But the current retail market is such that survival is dependent on innovation, as it becomes a decisive factor in customer retention. What’s more, key cost-cutting efficiencies and revenue optimization opportunities are dependent on technological infrastructure. Retailers can conciliate the need to innovate with the need to cut costs by making smart, tactical, and forward-thinking investments.

Brand loyalty is the canary in the coal mine of an economy in a downturn. As shoppers become more and more price-sensitive and lean into special offers and low-cost items, competition shifts gears. This spells opportunity for innovative, forward-thinking retailers. This is also the finest hour for discounters, who would be able to increase their market share significantly if they take the right steps to differentiate themselves. To avoid rolling higher costs of goods onto shoppers and losing CLV to competitors, retailers must reimagine their business and locate value and efficiencies across the entire retail chain.

Automation technologies, particularly those powered by advanced artificial intelligence capabilities, can unlock efficiencies. In addition to streamlining store operations and reducing dependencies on expensive labor, smart solutions deliver rich data insights that empower retailers to make smart decisions, from store layouts to product range. That is the reason many forward-thinking retailers are betting on automation. By the end of its fiscal year 2026, Walmart said it expects about 65% of its stores will have automation capabilities, 55% of its fulfillment center volume will move through automated facilities, and unit cost averages could fall by some 20%.

Retailers, especially industry giants like Walmart, play a long game. The investments they make today are designed to help them compete years from now. Walmart’s commitment to automation signifies that the retail giant sees it as the bedrock of their future operations.

How automation unlocks growth opportunities

Cashierless checkout reduces, and in certain cases completely removes, retailers’ dependency on cashier labor, which, according to PWC, amounts on average to 30%-40% of retailers’ labor costs. This doesn’t necessarily mean the elimination of these jobs altogether. Rather, retailers may choose to reallocate low-impact, high-churn cashier jobs towards high-impact jobs in store such as stock upkeep and customer service.

When checkout is done seamlessly, as with Trigo’s computer vision-powered solution, it frees up the prized in-store real estate previously held by cashiers and checkout lines. This space, too, could be leveraged for value-adding functionalities, from additional product ranges to experiential functions like in-store dining areas. An average supermarket manned till “costs” a retailer approximately 5-12 sqm of its real estate, plus the queuing space. What could you do with this much more space?

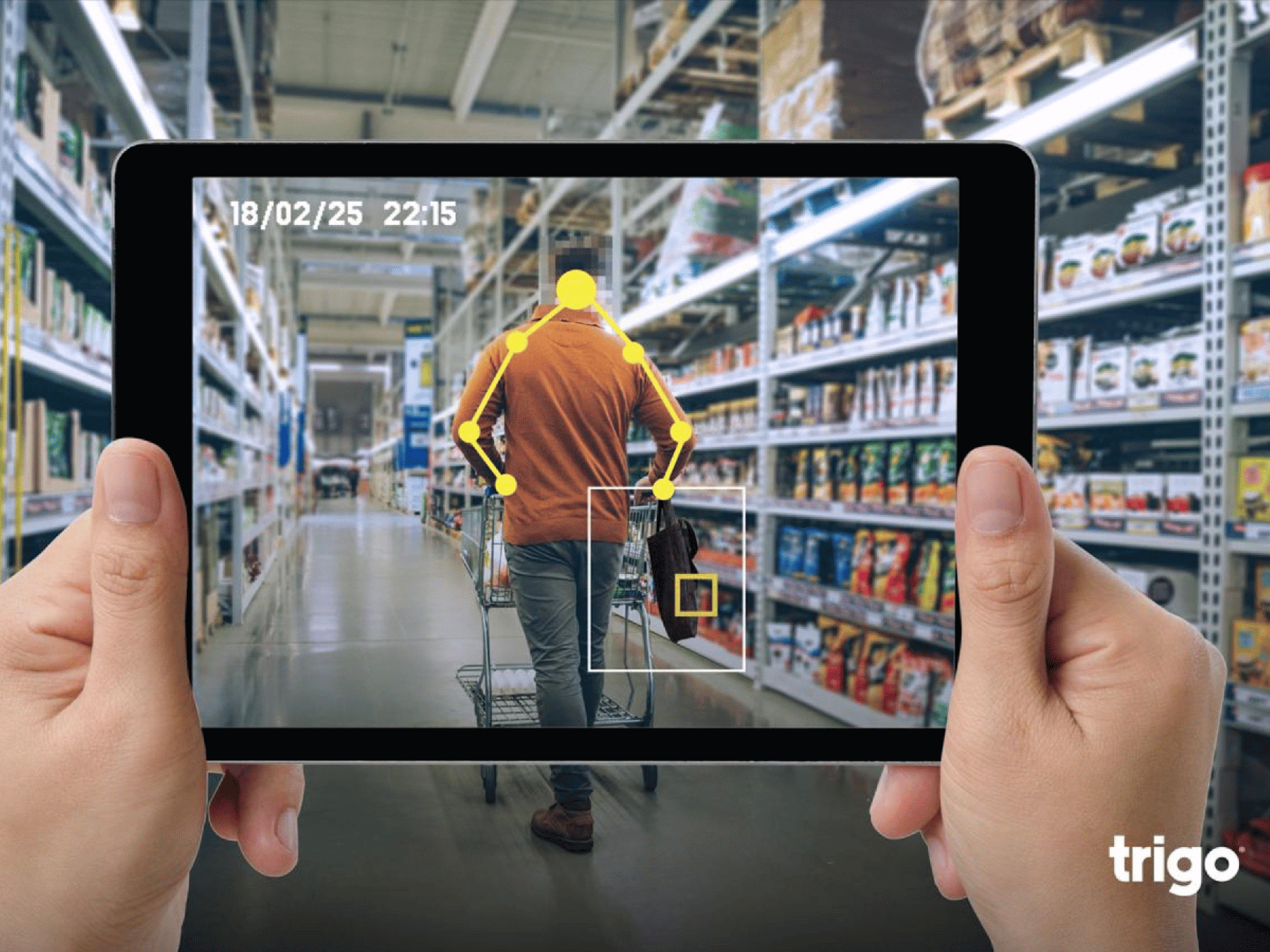

The entry of AI-powered automation solutions into retail also marks the era of data-driven operations. Data, like that collected and analyzed–anonymously–by computer vision-powered solutions, is translated into rich insights on shoppers’ journeys. These insights help retailers optimize product range, store layout, and planograms to maximize conversion and shopper satisfaction. It elevates stock management to increase product availability, reduce waste, and cut costs. Shopper data powers better, more targeted promotions, while the technical infrastructure supporting cashierless checkout can also enable event-based marketing and in-store media. Perhaps most critically, computer vision automated checkout is shown to reduce shrink significantly.

All these cost-cutting and revenue-optimizing measures add up to a measurable return on tech investment.

But, Amazon…

Retail automation solution developers owe a lot to Amazon. With its introduction of the Just Walk Out technology in 2016, the tech giant introduced a new benchmark of innovation into a mostly traditional market, effectively changing the rules of the game and propelling the market penetration of seamless checkout technologies. Much as Amazon is a leader in eCommerce, many traditional retailers have begun viewing it as a leader in brick-and-mortar, too, looking to Amazon’s activities to dictate the pace of their own tech investment. So what should we make of the fact that even a giant like Amazon is apparently scaling back its brick-and-mortar investment? And how should retailers assess Amazon’s slower deployment of innovative store formats?

The answer is complicated. While Amazon’s eCommerce leadership is unchallenged, it is not immune to macroeconomic shifts, and in fact, has more exposure to the current tech crisis that has forced even the Big Five tech giants into painful layoffs. What’s more, Amazon is not immune to the challenges of establishing a physical retail footprint. As it entered the world of physical retail, it was introduced to a new and unique set of challenges. The company quickly opened a slew of physical locations, and then quickly shut down several stores. Recently, and in light of multiple store closures, Amazon made a statement to reiterate its commitment to Amazon Go formats and physical retail, potentially by way of acquisition.

Even as Amazon is readjusting its investment to weather a potential economic storm, the progress it introduced to physical retail, and the shopper expectations it ignited, could not be dialed back. Amazon helped usher in a competitive retail environment that is fueled by tech innovation, and traditional retailers must keep up to retain customers who have encountered new standards of convenience –and are willing to pay for it.

As Amazon is occupied with assessing its priorities and scaling back its spending, retailers have a golden opportunity to beat the giant in its own game and establish themselves as innovation leaders in their own rights.

How can tech innovators become better tech partners

As retailers work to adapt their business and operations to the demands of a fluctuating economy, retail tech partners must also adapt to the changing needs and tighter purses of retailers and focus on adding value. This could involve a significant recalibration of priorities and R&D investment.

The key question to ask is how to deliver the most value to retailers right now. Working closely with our retail partners, we see them responding to their shoppers’ changing needs and expectations. One area where we are able to support this effort is by leveraging our unique in-store data to deliver insights on changing consumer behaviors such as product interaction and choices and shoppers’ in-store journeys.