Grocers don’t like revolutions. They prefer a steady rhythm of predictable inventory and clientele, stable suppliers, and seasonal promotions. Then COVID-19 hit, and almost everything closed, except for grocery stores (and hospitals).

Seasonal promotion spikes now happen every day, as stay-at-home shoppers and social distancing mean grocers must meet the demand for digital orders, modernize and boost their delivery logistics, while simultaneously limiting the number of shoppers allowed into their stores at any one time. This is the new normal, and grocers who successfully adapt could take advantage of a boom in demand. A number of macro forces are driving this: generational change, urbanization, and the rise of mobile technology and e-commerce are gathering pace, along with the growing demand for convenience and speed.

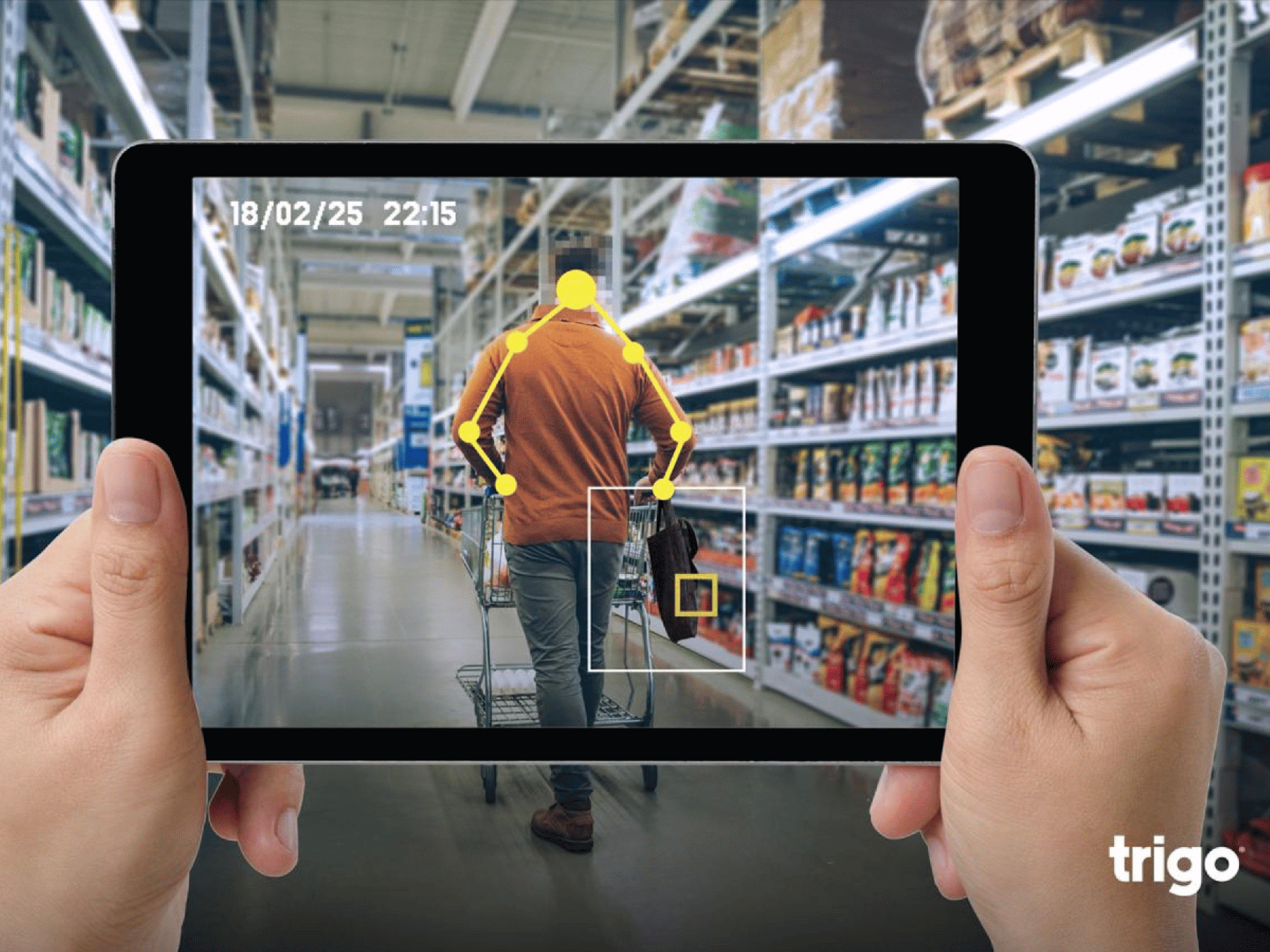

At Trigo have already retrofitted existing stores, with more on the way, and we’re continuing to build out our technology. The following thoughts are based on our real-world experience of deploying our technology together with our partners.

The physicality of convenience

Since Amazon acquired Whole Foods in 2017 and later introduced Amazon Go in 2018, the grocery industry has been faced with a new challenge: What happens when the consumer expectations of speed, convenience, and safety also extend to the physical retail experience? There are times when ordering online simply doesn’t work. For example, if commuters are on their way to or from work, or on their lunch breaks, it’s simpler to just walk into a store, grab something and leave. There are also times when the tactile aspects of grocery shopping prevail: the smell of fresh food, the look of a prime cut of meat, or the touch and feel of produce — these are visceral experiences that are hard to match online, and so they should be.

And while eCommerce is growing, the overwhelming number of grocery shopping around the world is still done physically in the store (some 95%). Physical grocery retail isn’t going anywhere soon. And even after our pandemic-induced, socially-distanced world goes back to some semblance of normality, buying groceries physically will still need to be safe, convenient, and quick. Widespread adoption of checkout-free grocery retail then becomes a matter of when, not if.

Challenge #1: The race is on

Amazon already has 26 Amazon Go locations either planned or in operation, with plans to license its technology to airport convenience store operators. But Amazon isn’t the only one. Companies worldwide have begun piloting checkout-free retail in various forms. Nano stores, hybrid stores, employee-only lab stores, and other concept stores have become part of the grocery industry’s new vernacular.

But when it comes to true computer vision-based walk in, grab your items, and leave the store without any friction or checkout counter, there are two main considerations — the size of a store and the number of stores within a retailer’s portfolio.

Right now, the cost of a computer vision hardware setup — centered around cameras, sensors, and servers — is still relatively expensive. According to estimates, the hardware for the first small-sized Amazon Go boxes cost over $1 million.

These costs also move linearly, so if a store goes from 3,000 square feet (the approximate size of an Amazon Go) to 6,000 square feet, the cost of the hardware deployment essentially doubles. The number of sensors and cameras needed per store also increases accordingly.

The good news is that the cost of technology goes down over time (thanks to Moore’s Law), but the hardware a retailer deploys today needs to have the ability to scale over time. If the hardware is custom-built, expensive, and only for small, nano-type footprints versus an average grocery store box (approximately 40,000 square feet), it likely isn’t worth the effort. In the long run, off-the-shelf sensors, as opposed to custom-built ones, can likely produce more cost-effective systems.

Challenge #2: Show me the power

Next, the computational power required to run a store also increases with store size. Bigger stores also generally have more products on their shelves. The average US grocery store, for instance, has somewhere between 30,000 and 40,000 stock keeping units (SKUs), while convenience stores can carry as few as 500 SKUs. More items mean more data that the system needs to monitor and more item imagery that needs to be managed in the back office.

For any AI network to work, it takes anywhere between 1,000 – 5,000 images to be able to recognize and classify a category of items. Multiply this requirement by the number of SKUs per store and soon you are in the range of tens or hundreds of millions of images that a retailer needs to maintain — which is a prohibitive undertaking for even well-resourced technology companies, let alone grocery retailers to handle.

Challenge #3: It’s complicated, and that’s just the way we like it!

For computer vision to be effective, it must work in settings and scenarios it understands. Retail operations are rarely the same size and shape from one store to the next. Ceiling heights, lighting, the dimensions of the physical footprint, the placement of the air conditioning units, and even the specific products carried from one store to the next can vary to a large degree. This adds to the complexity of the AI job at hand.

Conclusion

The answer is not to try to build new stores specifically for Artificial Intelligence Computer Vision (AICV) systems, but to convert existing stores into AICV systems able to deal with real-life scenarios. The faster AICV systems can be piloted in real-life situations, the more adaptive they will be to changes between stores at scale. This is what we at Trigo have been working on — scaling the AICV technology to power autonomous stores. So while fully autonomous driving is still very much in the testing phase, we already have a working solution.